Should I pay off my credit card in full or leave a small balance?

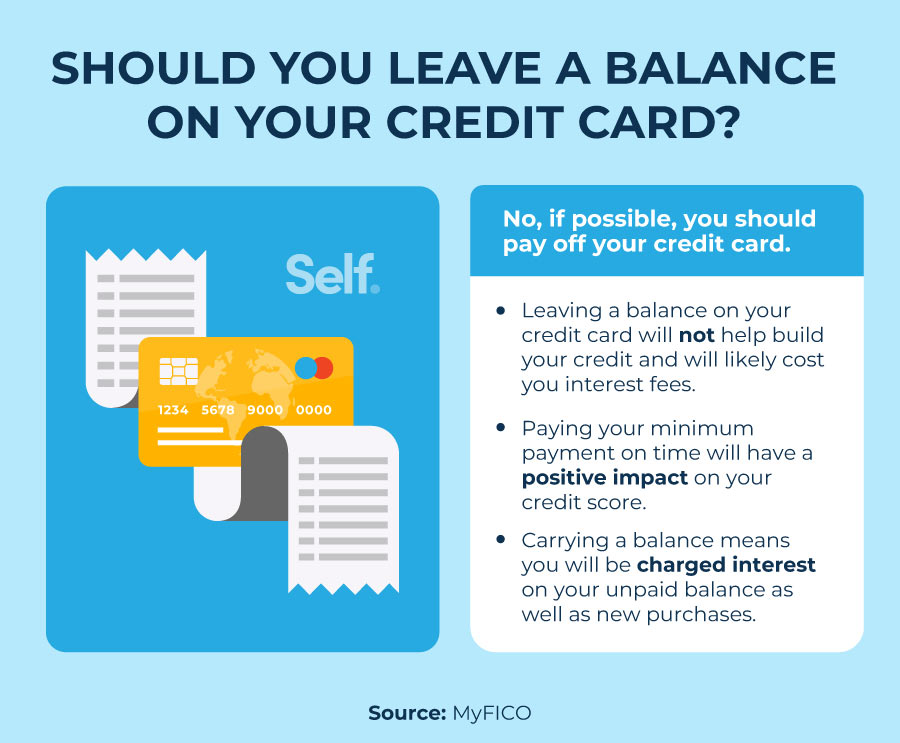

You'll avoid paying interest if you pay your credit card balance off in full each month by the due date. Establish a better credit score: Using your credit card and repaying your balance will help you establish a good payment history.Despite the myth, it’s a better idea to pay bills in full every month rather than carrying a small balance on your credit card. Carrying a balance does not help your credit score, and it costs you money in interest charges. A good rule of thumb is to pay off as much of your balance as possible every month.

Is it better to pay off credit card in full or keep balance?

It's a good idea to pay off your credit card balance in full whenever you're able. Carrying a monthly credit card balance can cost you in interest and increase your credit utilization rate, which is one factor used to calculate your credit scores.

Is it better to pay off the smallest balance or get all credit cards under 30% utilization?

The bottom line Reporting a balance on your cards of more than about 30 percent of its maximum credit line will hurt your score and carries additional risks. The lower your balances, the better your score — and a very low balance will keep your financial risks low.

Do credit card companies like when you pay in full?

Yes, credit card companies do like it when you pay in full each month. In fact, they consider it a sign of creditworthiness and active use of your credit card. Carrying a balance month-to-month increases your debt through interest charges and can hurt your credit score if your balance is over 30% of your credit limit.

How much balance should I leave on credit card?

The general rule of thumb has been that you don't want your CUR to exceed 30%, but increasingly financial experts are recommending that you don't want to go above 10% if you really want an excellent credit score.

Is it better to pay off credit card in full or keep balance?

It's a good idea to pay off your credit card balance in full whenever you're able. Carrying a monthly credit card balance can cost you in interest and increase your credit utilization rate, which is one factor used to calculate your credit scores.

Is it better to pay off the smallest balance or get all credit cards under 30% utilization?

The bottom line Reporting a balance on your cards of more than about 30 percent of its maximum credit line will hurt your score and carries additional risks. The lower your balances, the better your score — and a very low balance will keep your financial risks low.

Why does credit score go down when you pay off credit card?

Similarly, if you pay off a credit card debt and close the account entirely, your scores could drop. This is because your total available credit is lowered when you close a line of credit, which could result in a higher credit utilization ratio.

Is it bad to have a lot of credit cards with zero balance?

It is not bad to have a lot of credit cards with zero balance because positive information will appear on your credit reports each month since all of the accounts are current. Having credit cards with zero balance also results in a low credit utilization ratio, which is good for your credit score, too.

How much of my $500 credit limit should I use?

It's commonly said that you should aim to use less than 30% of your available credit, and that's a good rule to follow.

How much should you spend on a $5000 credit limit?

How much of a 1500 credit limit should I use?

Experts generally recommend maintaining a credit utilization rate below 30%, with some suggesting that you should aim for a single-digit utilization rate (under 10%) to get the best credit score.

What are the cons of paying credit card in full?

Cons to paying off old credit card debt Any payment toward that debt will allow debt collectors to put it on your credit report for another seven years and pursue collections against you aggressively.

What are the three Cs of credit?

Students classify those characteristics based on the three C's of credit (capacity, character, and collateral), assess the riskiness of lending to that individual based on these characteristics, and then decide whether or not to approve or deny the loan request.

How much should I spend if my credit limit is $1000?

A good guideline is the 30% rule: Use no more than 30% of your credit limit to keep your debt-to-credit ratio strong. Staying under 10% is even better. In a real-life budget, the 30% rule works like this: If you have a card with a $1,000 credit limit, it's best not to have more than a $300 balance at any time.

How much should I spend on a 400 credit limit?

You should aim to use no more than 30% of your credit limit at any given time. Allowing your credit utilization ratio to rise above this may result in a temporary dip in your score.

How can I build my credit fast with a credit card?

Just pay off your credit card bill in full and on time each month, and the card issuer will report your payments to the credit bureaus. By paying in full, you also won't have to pay interest. Your payment history makes up 35% of your FICO credit score, so this is one of the best things you can do to build your credit.

How to pay off credit card to increase credit score?

Just pay off your credit card bill in full and on time each month, and the card issuer will report your payments to the credit bureaus. By paying in full, you also won't have to pay interest. Your payment history makes up 35% of your FICO credit score, so this is one of the best things you can do to build your credit.

How many points will my credit score increase when I pay off credit cards?

If you're already close to maxing out your credit cards, your credit score could jump 10 points or more when you pay off credit card balances completely. If you haven't used most of your available credit, you might only gain a few points when you pay off credit card debt.

What happens if I pay off my credit card early?

Paying your credit card early reduces the interest you're charged. If you don't pay a credit card in full, the next month you're charged interest each day, based on your daily balance. That means if you pay part (or all) of your bill early, you'll have a smaller average daily balance and lower interest payments.

When should I pay my credit card bill to increase credit score?

The best time to pay a credit card bill is a few days before the due date, which is listed on the monthly statement. Paying at least the minimum amount required by the due date keeps the account in good standing and is the key to building a good or excellent credit score.

Is it better to pay off credit card in full or keep balance?

It's a good idea to pay off your credit card balance in full whenever you're able. Carrying a monthly credit card balance can cost you in interest and increase your credit utilization rate, which is one factor used to calculate your credit scores.

Is it better to pay off the smallest balance or get all credit cards under 30% utilization?

The bottom line Reporting a balance on your cards of more than about 30 percent of its maximum credit line will hurt your score and carries additional risks. The lower your balances, the better your score — and a very low balance will keep your financial risks low.

How much does paying off credit card raise score?

If you're already close to maxing out your credit cards, your credit score could jump 10 points or more when you pay off credit card balances completely. If you haven't used most of your available credit, you might only gain a few points when you pay off credit card debt.

Is it true that the only way to improve your credit score is to pay off your entire balance every month?

If you regularly use your credit card to make purchases but repay it in full, your credit score will most likely be better than if you carry the balance month to month. Your credit utilization ratio is another important factor that affects your credit score.